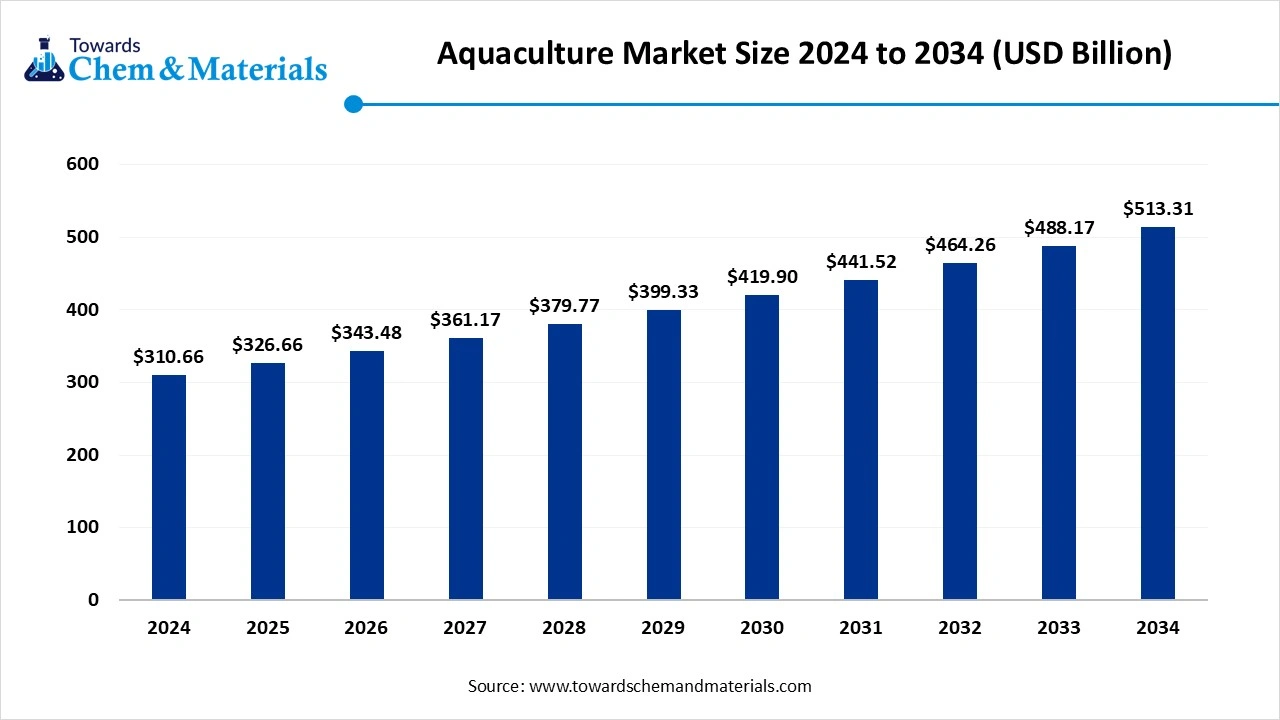

Aquaculture Market Size to Worth USD 513.31 Billion by 2034

According to Towards Chemical and Materials, the global aquaculture market size is calculated at USD 326.66 billion in 2025 and is expected to be worth around USD 513.31 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

Ottawa, Oct. 08, 2025 (GLOBE NEWSWIRE) -- The global aquaculture market size was valued at USD 310.66 billion in 2024 and is anticipated to reach around USD 513.31 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5886

Aquaculture Overview

The global aquaculture market is experiencing robust momentum, propelled by escalating consumer demand for seafood as a high quality protein source and mounting pressure on wild fish stocks, prompting a shift toward farmed production, this sector spans a diverse array of species, culture environments, and farming systems, and is increasingly shaped by innovations in technology, sustainability practices, and feed formulation including recirculating systems, integrated multi trophic approaches, and alternative feed ingredient which together are redefining production efficiency, environmental impact, and economic viability in aquaculture.

Aquaculture Market Report Highlights

- The Asia Pacific aquaculture market size was estimated at USD 217.46 billion in 2024 and is projected to reach USD 362.40 billion by 2034, growing at a CAGR of 5.24% from 2025 to 2034.

- By region, the Asia Pacific dominated market with approximately 70% share in 2024.

- By species, the finfish segment held approximately a 58% share in the market in 2024.

- By culture environment, the marine segment held approximately a 50% share in the market in 2024.

- By farming system, the ponds segment held approximately a 40% share in the aquaculture market in 2024.

- By feed & nutrition, the compound aquafeeds segment held approximately a 65% share in the market in 2024.

- By end-use application, the human food consumption segment held approximately an 85% share in the market in 2024.

- By processing & product form, the chilled/frozen fillets segment held approximately a 60% share in the aquaculture market in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5886

Aquaculture Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 343.48 billion |

| Revenue forecast in 2034 | USD 513.31 billion |

| Growth rate | CAGR of 5.15% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Species Cultured, By Culture Environment, By Farming System, By Feed & Nutrition, By End-Use Application, By Processing & Product Form, By Region |

| Key companies profiled | Blue Ridge Aquaculture; Cermaq ASA; Cooke Aquaculture Inc.; Eastern Fish Co.; Huon Aquaculture Group Pty Ltd.; International Fish Farming Co. - Asmak; RoyMarine Harvest ASA; Nireus Aquaculture S.A; Promarisco; Selonda Aquaculture S.A. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products In Aquaculture Market

- Atlantic Salmon- Farm-raised premium salmon for global seafood markets.

- Tilapia- Naturally raised tilapia from lake-based aquaculture systems.

- Shrimp- One of the world’s largest shrimp producers, with full supply chain integration.

- Aquafeed- High-performance, sustainable fish feed tailored to species needs.

- GM Salmon (AquAdvantage Salmon)- Genetically modified salmon that grows faster with less feed.

- RAS Equipment & Filtration Systems- Recirculating Aquaculture System (RAS) components and water treatment systems.

- Salmon Roe & Smolt- Early life-stage salmon products for farming or processing.

- Value-Added Seafood Products- Processed, ready-to-eat or frozen seafood for retail and food service markets.

- Offshore Aquaculture Technology (Smart Farms)- Pioneering offshore salmon farming platforms like Ocean Farm 1.

- Nutritional Additives for Aquafeed- Functional feed additives improving fish health, immunity, and growth.

What Are the Major Trends in The Aquaculture Market?

- Increasing adoption of recirculating aquaculture systems (RAS) driven by the focus on reducing environmental impacts and improving water use efficiency.

- Rising use of alternative protein sources in aqua feeds to address feed security and reduce reliance on traditional fishmeal.

- Growing interest in aquaculture for nutraceuticals and pharmaceutical applications as demand for functional ingredients from aquatic species rises.

- Expansion of aquaculture operations in brackish water environments in response to freshwater scarcity and coastal resource potential.

How Does AI Influence the Growth of The Aquaculture Market In 2025?

Artificial intelligence is reshaping the aquaculture market by enhancing precision, efficiency, and sustainability across farming operations. AI powered monitoring systems help farmers track fish health, water quality, and feeding behaviour in real time, reducing waste and improving stock management. Smart automation supports disease detection and early intervention, helping maintain healthier yields with fewer losses. Predictive analytics optimize feed use, harvest timing, and environmental conditions, lowering operational risks and resource consumption. AI also streamlines supply chain planning and traceability, creating more transparent and resilient distribution networks. Altogether, these advancements position AI as a key catalyst for innovation, productivity, and long-term growth in the sector.

Aquaculture Market Growth Factors

Is Rising Global Seafood Demand Shaping Aquaculture?

Growing awareness of seafood as a healthy protein source is pushing more consumers toward fish and shellfish, especially in region where dietary shifts favour lean and sustainable options. This has encouraged farmers and governments to expand production capacity to meet changing consumption habits.

Can Sustainable Practices Driver Wider Adoption?

The push for responsible farming methods, such as better feed management and lower impact systems, is motivating producers to invest in improved technologies and regulations that support long term viability. This shift is helping the industry align with environmental expectations while keeping production stable.

Market Opportunity

Can Aquaculture Tap into The Rise Of Blue Carbon Solutions?

Coastal and marine farming projects that integrate species like oysters, mussels, and seaweed are being recognized for their role in carbon capture and ecosystem restoration. These systems can help improve water quality, rebuild marine habitats, and sequester carbon more effectively than many land-based systems. As interest in nature-based climate strategies grows, aquaculture businesses can explore partnerships, certification Chemins, and emerging blue carbon credit markets. This creates new revenue pathways that go beyond primary seafood production.

Is Technology Adoption Opening Doors For Small Producers?

Digital tools such as remote water monitoring, mobile advisory platforms, and automated feeders are becoming more accessible to small and mid-scale farmers. These solutions help improve farm management, reduce waste, and support compliance with sustainability standards. Wider access to mobile connectivity and open source tools allows producers in emerging economies to modernize without heavy infrastructure costs. This growing inclusivity supports local livelihoods while expanding the commercial ecosystem of service providers in aquaculture.

Limitations In The Aquaculture Market

- Difficulty in maintaining water quality and managing waste disposable in intensive culture systems, which can strain environmental sustainability and operational costs.

- Dependence on high quality feed inputs and raw materials, making the sector vulnerable to fluctuation in ingredient supply and prices.

Aquaculture Market Segmental Insights

Species Insights

Why Is Finish Segment Dominating The Aquaculture Market?

The finfish segment dominated the market in 2024. The global preference for finfish such as salmon, tilapia, and sea bass is driven by their high nutritional value, versatility in cooking, and strong consumer demand across regions. Advances in breeding techniques and farm management have enhanced yields consistent and reduced production risks, making finish an attractive choice for both small scale and commercial aquaculture farms. Additionally, the established global supply chains and export networks for finish support sustained growth and market dominance, reflecting its central role in the overall aquaculture ecosystem.

The crustaceans segment is projected to expand rapidly in the coming years. Rising demand for high value seafood items like shrimp and lobster in international market, coupled with innovations in farming and disease management, is accelerating production. Investments in hatchery technologies and feed optimization are enabling farmers to cultivate crustaceans efficiently while minimizing losses. This growth is further fuelled by premium pricing and increasing consumer preference for protein rich luxury seafood, making crustaceans a rapidly emerging segment in the global aquaculture market.

Culture Environment Insights

Why Is The Marine Segment Dominating Aquaculture Market?

The marine segment dominated the market in 2024. Marine aquaculture benefits from natural coastal conditions and expansive water bodies that allow large scale cultivation of species such as salmon, sea bass, and shellfish. Farmers are leveraging established marine ecosystems alongside improved monitoring and sustainable practices to maximize yield. The combination of high consumer demand and established market infrastructure positions marine aquaculture as a dominant environment segment, critical for meeting global seafood needs.

The brackish water segment is expected to grow with the highest rate in the studied years. Brackish water aquaculture allows the farming of diverse species like shrimp and tilapia in estuarine and coastal zones, making efficient use of semi saline environments. Emerging techniques in water management, disease control, and feed efficiency are expanding production potential in these areas. This growth is supported by increasing recognition of brackish water systems as sustainable solutions for high value seafood cultivation, creating significant opportunities for farmers worldwide.

Farming Insights

Why Are Ponds Segment Dominating The Aquaculture Market?

The ponds segment maintained a leading position in the market in 2024. Ponds provide a flexible and cost effective environment for cultivating a wide range of species, from finish to crustaceans. Their adaptability allows both small scale and commercial farmer to control water quality, feed schedules, and stock density efficiently. The extensive experience and infrastructure built around pond farming in regions like Asia Pacific strengthen its dominance, while integration with modern management practices enhances productivity and sustainability.

The recirculating aquaculture systems (RAS) segment is projected to experience the fastest growth in the market during the forecast period. RAS technology allows intensive farming in controlled indoor environments, reducing water usage and environmental impact while enabling year round production. Innovations in filtration, oxygenation, and automated monitoring make RAS an attractive choice for high value species. The increasing focus sustainable and climate resilient farming methods is driving adoption of RAS globally, positioning it as a key growth segment.

Feed And Nutrition Insights

Why Are Compound Aqua Feeds Segment Dominating The Aquaculture Market?

The compound aqua feeds segment dominated the market in 2024. Compound feeds provide balanced nutrition optimized for growth, health, and feed conversion efficiency, which enhances overall productivity. Their formulation flexibility allows adaptation for different specifies, life stages, and culture environments, supporting consistent quality across farms. The resilience on compound feeds is strengthened by ongoing research to improve digestibility and reduce environmental waste, securing their dominant position in the aquaculture nutrition market.

The alternative proteins segment is anticipated to grow with the highest rate in the coming years. Rising sustainability concerns and the high cost of traditional fishmeal are encouraging adoption of plant based, insect based, and microbial protein sources. These alternative feeds help reduce environmental impact while maintaining growth performance and health of cultured species. Innovation in feed processing and formulation is making alternative proteins more accessible, driving rapid expansion in this segment.

End Use Application Insights

Why Are Human Food Consumption Segment Dominating The Aquaculture Market?

The human food consumption segment dominated the market in 2024. The majority of aquaculture production is targeted toward meeting the growing global demand for seafood as a healthy and protein rich food source. Consumer preference for fresh, high quality seafood and ready to cooks products ensures that human consumption remains the primary application of framed aquatic species. Distribution channels, including retail, restaurants, and exports, reinforce the importance of this segment, highlighting its critical role in sustain market demand.

The nutraceuticals and pharma segment is projected to experience the highest growth rate in the market during the forecast period. Compounds derived from fish, crustaceans, and algae, such as omge-3 fatty acids, bioactive peptides, and collagen, are increasingly used in dietary supplements and medical products. Rising health awareness, the demand for functional foods and therapeutic ingredients are driving expansion of this segment. As aquaculture diversifications into high value, specialized products, nutraceuticals and pharma applications present significant growth opportunities globally.

Processing And Product Form Insights

Why Are Chilled/Frozen Fillets Segment Dominating The Aquaculture Market?

The chilled/ frozen fillets segment maintained a leading position in the market in 2024. This product form ensures longer shelf life and convince for consumers while preserving nutritional value and taste. Established cold chain infrastructure, strong retail distribution, and consumer preference for ready to cook seafood reinforce its dominance. Chilled and frozen fillets allow producers to service both domestic and international markets efficiently, cementing their pivotal role in aquaculture product processing.

The value added processed segment is projected to expand rapidly in the market in the coming years. Innovations in packaging, ready to eat meals, marinated seafood, and frozen convenience products are creating new consumption occasions and increasing product appeal. Rising demand for convenience food s and premium seafood products is driving investments in processing technology. This segment represents a high growth opportunity as aquaculture integrates processing with value addition to meet evolving consumer lifestyles and preferences.

Regional Insights

Why Is Asia Pacific Dominating The Aquaculture Market?

Asia Pacific dominated the global aquaculture market in 2024, driven by its extensive coastline, favourable climatic conditions, and well established aquaculture practices. The region’s dominance is further bolstered by significant contribution to global seafood production, with countries like China and India leading the way. The high demand for seafood in Asia Pacific, coupled with advancements in aquaculture technologies and sustainable practices, has propelled the region to the forefront of the industry. As consumer preferences shift towards healthier and more sustainable food sources, Asia Pacific’s aquaculture sector is poised for continued growth and innovation. This regional leadership underscores the importance of Asia Pacific in meeting the world’s increasing seafood demands.

China and India play pivotal roles in the aquaculture market, each contributing uniquely to industry’s growth. China, with its extensive aquaculture infrastructure and technological advancements, has become a global leader in seafood production, supplying both domestic and international markets. India, on the other hand, has seen surge in aquaculture activities, particularly in states like Andhra Pradesh, where shrimp farming has been a significant economic driver. However, challenges such as disease outbreaks and fluctuating market prices have impacted profitability, prompting farmers to explore alternative species and farming methods. Despite these challenges, both nations continue to innovate and adapt, ensuring their central roles in the evolving aquaculture landscape.

Why Is North America Emerging As The Fastest Growing Aquaculture Market?

North America expected to experience the rapid growth in the aquaculture market during the forecast period, driven by increasing consumer demand for sustainable and locally sourced seafood. Technological advancements, such as recirculating aquaculture systems (RAS), are enhancing production efficiency and environmental sustainability. Government initiatives and favourable policies are further supporting industry expansion. The region’s focus on high value species and innovative farming practices positions it for continued growth in the market. These factors collectively contribute to North America’s emergence as a leader in the aquaculture industry.

The United States is a pivotal player in North America’s aquaculture expansion. The U.S. has seen a notable increase in aquaculture farms and product sales, particularly in states like Louisiana and Florida. Canada’s aquaculture industry is also growing, with a focus on sustainable practices and species diversification. Both countries are investing in research and development to enhance production methods and meet the rising demand for seafood. Their collaborative efforts and commitment to innovation are driving the region’s aquaculture market forward.

More Insights in Towards Chemical and Materials:

- Europe Copper Market : The Europe copper market size is calculated at USD 50.45 billion in 2024, grew to USD 53.1 billion in 2025, and is projected to reach around USD 84.16 billion by 2034. The market is expanding at a CAGR of 5.25 between 2025 and 2034.

- U.S. Biodiesel Market : The U.S. biodiesel market size accounted for USD 15.34 billion in 2024 and is predicted to increase from USD 16.08 billion in 2025 to approximately USD 24.63 billion by 2034, expanding at a CAGR of 4.85% from 2025 to 2034.

- U.S. Green Hydrogen Market : The U.S. green hydrogen market size is calculated at USD 274.19 million in 2024, grew to USD 379.07 million in 2025, and is projected to reach around USD 6,993.64 million by 2034. The market is expanding at a CAGR of 38.25% between 2025 and 2034.

- U.S. Renewable Diesel Market : The U.S. renewable diesel market size is calculated at USD 11.55 billion in 2024, grew to USD 12.33 billion in 2025, and is projected to reach around USD 22.28 billion by 2034. The market is expanding at a CAGR of 6.79% between 2025 and 2034

- Europe Polymer Market : The Europe polymer market size was approximately USD 385.31 billion in 2024 and is projected to reach around USD 642.73 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.25% between 2025 and 2034.

- Polymer Foam Market : The global polymer foam market size was approximately USD 160.43 billion in 2025 and is projected to reach around USD 273.58 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034.

- Regenerative Agriculture Market : The global regenerative agriculture market size accounted for USD 12.95 billion in 2024 and is predicted to increase from USD 15.38 billion in 2025 to approximately USD 72.21 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Flat Steel Market : The global flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Lactic Acid Market : The global lactic acid market is expected to reach a volume of approximately 1,550.12 Thousand tons in 2025, with a forecasted increase to 3,306.02 Thousand tons by 2034, growing at a CAGR of 8.78% from 2025 to 2034.

- Mechanical Recycling of Plastics Market : The global mechanical recycling Of plastics market is expected to reach a volume of approximately 54.87 million tons in 2025, with a forecasted increase to 120.26 million tons by 2034, growing at a CAGR of 9.11% from 2025 to 2034.

-

Waterproofing Chemicals Market : The global waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

Aquaculture Market Top Key Companies:

- Pentair Aquatic Eco-Systems

- Bakkafrost

- CP Foods (Charoen Pokphand Foods)

- Alltech Coppens

- SalMar

- Grieg Seafood

- Cermaq

- Regal Springs

- AquaBounty Technologies

- De Heus Animal Nutrition

- Lerøy Seafood Group

- Tassal Group

- Zeigler Bros.

- AquaGen

- Benchmark Holdings

Recent Developments

- In August 2025, DNV, an independent assurance and risk management provider, has introduced an AI powered fish farm technology aimed at enhancing compliance with Norwegian government regulations. This innovation is set to save man hours, reduce operational costs, and prevent the loss of valuable fish stock, marking a significant advancement in aquaculture operations.

- In July 2025, Mitsubishi corporation has acquired their businesses from Norway’s Grieg Seafood ASA through its subsidiary, Cermak Group, aiming to boost Cermak’s annual salmon production from 200,000 tons to approximately 280,000tons by fiscal year 2027. This strategic sectors in response to global security concerns.

Aquaculture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Aquaculture Market

By Species Cultured

- Finfish

- Salmonids (salmon, trout)

- Carp species (common, grass, silver, bighead)

- Tilapia

- Catfish (channel, pangasius)

- Marine finfish (sea bass, sea bream, cobia, grouper, yellowtail)

- Other specialty cultured finfish (barramundi, basa)

- Crustaceans

- Shrimp (vannamei, black tiger)

- Prawns

- Crabs

- Lobsters

- Molluscs & Bivalves

- Oysters

- Mussels

- Clams

- Scallops

- Aquatic Plants & Algae

- Macroalgae/seaweed (nori, kelp, wakame, eucheuma)

- Microalgae (nutraceuticals, feed, industrial use)

- Other Aquatic Animals

- Sea cucumbers

- Ornamental fish & aquarium species

By Culture Environment

- Freshwater aquaculture

- Brackish water aquaculture

- Marine aquaculture

By Farming System

- Ponds (extensive, semi-intensive, intensive)

- Cages (nearshore, offshore)

- Tanks (flow-through, recirculating aquaculture systems – RAS)

- Biofloc systems

- Aquaponics systems

- Hatcheries & nurseries (broodstock, larval, juvenile)

By Feed & Nutrition

- Compound aquafeeds (extruded/pelletized)

- Hatchery & starter feeds (microdiets)

- Specialty functional feeds (medicated, probiotic, immune-boosting)

- Feed additives & supplements (enzymes, probiotics, amino acids, omega-3)

- Alternative proteins (insect meal, plant proteins, single-cell proteins, algae-based)

By End-Use Application

- Human food consumption (fresh, frozen, processed)

- Nutraceuticals & pharmaceuticals (algae bioactives, omega-3)

- Ornamental/aquarium trade

- Stock enhancement & restocking

- Industrial (fishmeal, fish oil, collagen, fertilizers)

By Processing & Product Form

- Live/fresh whole

- Chilled/refrigerated whole & fillets

- Frozen (IQF, block)

- Value-added processed (smoked, canned, ready-to-eat)

- By-products (fishmeal, fish oil, gelatin, collagen)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5886

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.