Mortgage Rates Hit 10-Month Low: Truss Financial Group Urges Buyers to Act Now

With rates dipping to their lowest point since October 2024, Truss Financial Group highlights opportunities for buyers and homeowners considering refinancing.

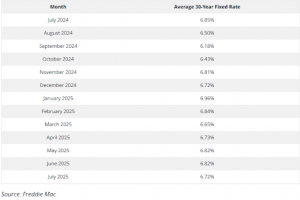

CA, UNITED STATES, September 9, 2025 /EINPresswire.com/ -- Truss Financial Group urges buyers to act now, as the national mortgage interest rates have reached a 10-month low, creating a timely opportunity for buyers. According to Freddie Mac’s latest weekly survey, the average U.S. 30-year fixed mortgage rate fell to approximately 6.58% in mid-August, the lowest level since October 2024. This decline, noted by financial media outlets such as CNBC, marks a significant turnaround that could improve affordability for potential homebuyers nationwide.

At these levels, even a slight drop in rates can translate into meaningful savings on monthly payments. First-time homebuyers who have delayed purchasing due to affordability concerns may now find their budgets stretch further. With rates in the mid-6% range, prospective buyers can qualify for larger loans or secure homes with more manageable mortgage payments.

Even existing homeowners may benefit: those who locked in higher rates last year could refinance now to reduce their long-term costs. Truss Financial Group emphasizes that this is a prime time for first-time buyers to explore homeownership options.

To help take advantage of this market shift, Truss Financial Group is highlighting its suite of first-time homebuyer programs and resources. These services are designed to break down common barriers to homeownership. The company’s offerings include advanced affordability tools and calculators that allow buyers to estimate payments and compare different loan scenarios under today’s rates.

TFG also provides free one-on-one mortgage consultations tailored to first-time homebuyers, where experts help clients set realistic budgets and understand their financing options. Additionally, the company hosts free educational resources via their YouTube channel to walk new buyers through each step of the purchase process. Many of TFG’s loan programs also feature reduced or zero down payment options to help qualified first-time buyers get into homes with less upfront cost.

Truss Financial Group’s first-time homebuyer initiatives include:

Personalized Guidance: One-on-one mortgage consultations that tailor financing plans to individual budgets and needs.

Affordability Planning: Interactive online calculators and budgeting tools to help buyers estimate payments and savings under current interest rates.

Educational Resources: Free homebuying resources on their YouTube channel, covering topics like credit building, down payment assistance, and navigating loan programs.

Flexible Financing: Mortgage products with reduced or no down payment requirements, including government-backed FHA, VA, and other specialized loans for new buyers.

“Lower mortgage rates in the mid-6% range are creating a rare window of opportunity for homebuyers right now,” said Jason, Chief Marketing Officer of Truss Financial Group.

“First-time buyers in particular have been waiting for a break like this. Our team is ready to provide personalized guidance, education, and the latest tools to help them navigate the market and make informed decisions. We believe this is an ideal time for buyers to act with confidence, and TFG is committed to helping every client find the right mortgage solution, whether it’s choosing the best loan program, setting a budget, or listening to one of our free educational resources.”

Recent data support Truss’s outlook. According to Fannie Mae’s May 2025 National Housing Survey, the Home Purchase Sentiment Index (HPSI) was up modestly from April and higher than the same period in 2024, signaling growing optimism among consumers despite affordability challenges. This uptick suggests more households are feeling confident about buying, even in a still-competitive market. While affordability pressures remain, the combination of improved sentiment and lower rates presents a unique moment for prospective buyers to enter the market.

Truss Financial Group encourages interested homebuyers and homeowners to learn more about these opportunities. Prospective buyers can visit the Truss Financial Group website to use affordability tools and sign up for a free consultation with a mortgage specialist.

Homeowners looking to refinance can call Truss’s loan officers to discuss potential savings under current rates.

About Truss Financial Group

Truss Financial Group is a leading national mortgage lender dedicated to helping Americans achieve homeownership. With a focus on education and personalized service, Truss offers a full range of mortgage products and first-time homebuyer programs across the country. The company’s mission is to empower every client with the guidance, tools, and flexible financing options they need to buy a home with confidence.

Jason Nichols

Truss Financial Group

+ +1 888-878-7715

pr@trussfinancialgroup.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.